Contents:

The pattern must have a long wick that sticks out from the surrounding price action. Dummies has always stood for taking on complex concepts and making them easy to understand. Dummies helps everyone be more knowledgeable and confident in applying what they know.

Russians Accused of Raping and Killing a 1-Year-Old Child, Says … – The Daily Beast

Russians Accused of Raping and Killing a 1-Year-Old Child, Says ….

Posted: Fri, 20 May 2022 07:00:00 GMT [source]

With that being said, let’s look at some examples of how candlestick patterns can help us anticipate reversals, continuations, and indecision in the market. The formation of the candle is essentially a plot of price over a period of time. For this reason, a one minute candle is a plot of the price fluctuation during a single minute of the trading day. The actual candle is just a visual record of that price action and all of the trading executions that occurred in one minute. According to Investopedia.com, it is commonly believed that candlestick charts were invented by a Japanese rice futures trader from the 18th century. And with enough repetition, enough practice, you just might find yourself a decent chart reader.

Bearish two-day trend reversal patterns

Such an example is the Wyckoff pattern, which is not only a chart pattern but also a theory. And when you trade a financial instrument using the Wyckoff pattern, you should know how to locate it and use it to find trading ideas. Another advanced chart pattern is the Parabolic pattern.

The falling three methods pattern is a bearish pattern that appears in a downtrend. The fifth and final red candle then falls significantly from its open below the previous candlestick’s close to a close below the close of the first candlestick. The falling three methods pattern suggests a bearish trend is likely to remain in effect despite a slight upside correction. Conversely, if the exchange rate closes below its open for a time frame, the candle will typically be red or black by default.

The Closing Price of Each Bar

Along the way, we’ll offer tips for how to practice this time-honored method of price analysis. While various bearish candlestick patterns are used, traders also rely on many bullish patterns as well. Bearish candlestick patterns visually show the failure of buyers to take a price higher and sellers take control of a chart for the timeframe of the price action.

We want the everyday person to get the kind of training in the stock market we would have wanted when we started out. We also offer real-time stock alerts for those that want to follow our options trades. You have the option to trade stocks instead of going the options trading route if you wish. Our traders support each other with knowledge and feedback. People come here to learn, hang out, practice, trade stocks, and more.

The candlestick pattern is favoured due to its simplicity and ease of analysis at a glance. The doji and spinning top candles are typically found in a sideways consolidation patterns where price and trend are still trying to be discovered. It can be found at the end of an extended downtrend or during the open. Emotions and psychology were paramount to trading in the 1700s, just as they are today.

They look similar however most of the time a green candle indicates bullish and a red candle indicates bearish. Candlestick cheat sheets are powerful tools to improve your trading skills and to be more efficient when identifying candlestick patterns in the Forex market. This is the opposite of the three white soldiers; it only forms near the end of up-trends and is made up of 3 bearish candles. The pattern indicates a reversal to the downside, with its three candles being a sign the bears have overridden the bulls and gained control of price. The pattern signals indecision and can form anywhere during a price move (uptrend/downtrend).

The spinning top signals indecsion, which makes it a neutral candlestick. The candle provides little useful info about the market price other than that the bulls and bears and locked in an intense battle with no decisive winner. HowToTrade.com takes no responsibility for loss incurred as a result of the content provided inside our Trading Room. By signing up as a member you acknowledge that we are not providing financial advice and that you are making the decision on the trades you place in the markets.

Low – This is the market that reached its lowest price during the trading session. This gives you an idea of how low the market moved in one trading period. Eventually, the price falls in this particular case as the trend becomes more extended into the rally. Correspondingly, the Shooting Star that occurs just beyond the Gravestone Doji is confirmation of that falling price action. Just as the high represents the power of the bulls, the low represents the power of the bears.

If you do not agree with any term of provision of our Terms and Conditions, you should not use our Site, Services, Content or Information. Please be advised that your continued use of the Site, Services, Content, or Information provided shall indicate your consent and agreement to our Terms and Conditions. In order to be successful, you need to be able to spot patterns as well. Doing so will drastically increase confidence and enable any trader to make accurate financial decisions when applying these concepts.

We https://1investing.in/ care what your motivation is to get training in the stock market. If it’s money and wealth for material things, money to travel and build memories, or paying for your child’s education, it’s all good. We know that you’ll walk away from a stronger, more confident, and street-wise trader.

Neutral Candlestick Pattern

These charts also display a variety of common candlestick patterns that forex traders can use to their advantage. The meaning and value of bearish candlesticks must be considered taking into the context of a chart pattern and their confluence with other signals. A bearish candlestick pattern that happens when a chart is overbought could signal a reversal of an uptrend. Bearish candles that happen late in a downtrend after a long term drop in price after a chart is already oversold can have a lower probability of success. Bullish candlestick patterns on a chart visually show buying pressure. These patterns can show the possibility of a price reversal during a downtrend or the continuation of an uptrend already in place.

Did NFL Coach Jerry Glanville Ever Win a NASCAR Race? – Sportscasting

Did NFL Coach Jerry Glanville Ever Win a NASCAR Race?.

Posted: Tue, 10 Jan 2023 08:00:00 GMT [source]

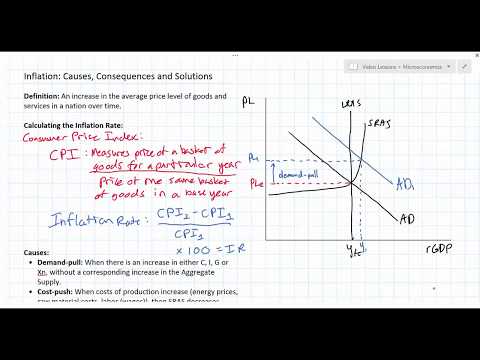

Candlestick charts originated in Japan as an informative and compact way to track market prices visually. They later became popular worldwide since they show reliable candle pattern types that traders can incorporate into their trading strategies. Most candlestick patterns are categorized into a few different groups. Some patterns are designed to send reversal signals to investors, while other patterns may simply be a reaffirmation of the current market momentum. It is important to use other forms of analysis, such as fundamental analysis and technical indicators, in conjunction with candlestick patterns to make informed trading decisions.

Bearish two-day trend continuation patterns

Candlesticks are one type of chart that can be used in technical analysis to look for repeating patterns and in correlation with other technical indicators and signals. A candlestick is a type of chart used in trading as a visual representation of past and current price action in specified timeframes. It’s important to treat day trading stocks, options, futures, and swing trading like you would with getting a professional degree, a new trade, or starting any new career. Candlesticks and patterns are the name of the game in trading. It doesn’t matter whether you’re new or a seasoned trader, we all have to learn them.

- I’d like to share these two printer-friendly cheat sheets I’ve made from the Babypips lessons.

- The exchange rate then gaps down to form a bigger bearish candle.

- Trading means you don’t have a preference whether the market goes up or down.

We believe the best way to do this is by understanding candlestick patterns. It can be challenging to narrow down the best candlestick pattern for scalping. For some, it is the shooting star and its inverse pattern the hammer, but opinions differ. More conservative traders might look for confirmation by waiting for another bearish candle to appear after the dark cloud pattern to signal a selling opportunity. In the first candle, a currency pair’s exchange rate rises significantly. The opening of the subsequent small bullish or bearish candle then gaps up.

Reliable Bullish Candlestick Pattern

Technically a 4 candle pattern, the rising three and falling three appear rarely in forex and signal a continuation of the previous trend or movement. The first candle always appears bullish and forms at the end of an uptrend/large upswing. The second candle is usually a Doji or spinning top pattern, either bullish or bearish. It shows the bears have begun battling it out with the bulls. The evening star is the bearish variant that only appears at the end of uptrends and indicates a reversal lower. Three white soldiers is the bullish variant of the pattern; you’ll find this forming at the end of downtrends.

Also, complex candlestick patterns that are made by two or more candles that usually include simple patterns to suggest a better approach of candlestick analysis. Candlestick patterns are separated into two groups, simple designs that stand for single candle formation that provide much information by itself, signaling a technical event. The three inside down formation is a bearish reversal pattern that foms at the end of up-trends. The first candle normally appears the smallest, as it forms after significant selling pressure.

Why Do Candlestick Patterns Matter?

According to Nison, the Japanese placed much less emphasis on the highs and lows of individual candles. For them, as it is for modern technicians, the opening and closing prices were more relevant. No doubt, there are countless ways to make money in the stock market.

Although this attempt may be unsuccessful initially, the inverted hammer candle signals that bullish pressure is emerging. A shooting star should have an upper wick at least twice the size of its body with only a small lower wick. This candlestick pattern suggests that a bullish run has reached its high, so a reversal could be in process. The bearish signal may fail, however, if the exchange rate subsequently continues to make gains.

For example, a composite index definition candlestick pattern is a basic chart pattern as it is a single candle pattern that can be easily recognized on candlestick charts. However, other patterns require a more in-depth understanding of the pattern’s structure, meaning, and how to use it properly. Learning about the more reliable candlestick patterns and how to trade them is a great way to boost your success as a forex trader.

Which NFL Teams Have Turf Fields? – Sportscasting

Which NFL Teams Have Turf Fields?.

Posted: Sun, 01 Jan 2023 08:00:00 GMT [source]

All website content is published for educational and informational purposes only. Trading forex on margin carries a high level of risk and may not be suitable for all investors. Exit a trade for profit, or realise a loss if the trend is going against you. Once mastered, each day will present a new trading opportunity.

Perhaps even print out the candlestick pattern cheat sheet and have it on your trading desk. Memorizing so many candlesticks patterns will never be a walk in the park. However, with this cheat sheet, you now have a simple way to quickly identify the key patterns as well as easily figure out what they signal. A bullish reversal pattern, the three inside up only forms at the end of downtrends and indicates a move to the upside. One of the few continuation patterns on this list, the inside bar forms when multiple candlesticks form within the range of a single candlestick, known as the mother bar.

The body of the green candle needs to engulf or be slightly bigger than the red candle. While line charts help give us an overall movement of the stock, bar charts are more detailed and are suitable for demonstrating or spotting the classical price patterns. A common anomaly in the charts is when there is a gap in Forex prices. But even in this case, there are trading opportunities for those who know how to interpret them. Determine significant support and resistance levels with the help of pivot points.

If the closing price is higher than the open price, then the candle is green or white. The body of a candle represents the distance between open to close, and the upper and lower wicks represent the highs and lows of a candle. We introduce people to the world of trading currencies, both fiat and crypto, through our non-drowsy educational content and tools. We’re also a community of traders that support each other on our daily trading journey.